We must explain to you how all seds this mistakens idea denouncing pleasures and praising account.

Expertise &

Experience

Comprehensive

Services

Efficiency &

Reliability

Reputation &

Trust

Long-Term

Partnership

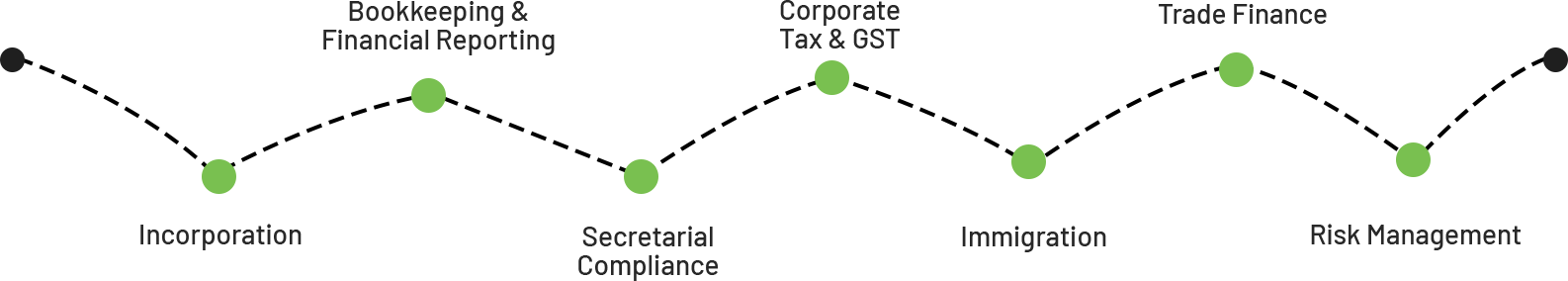

Are you an Indian entrepreneur looking to expand your business into Singapore? Incorporating a company in Singapore is a strategic move due to its favorable business environment, tax benefits, and ease of doing business.

Business-Friendly Environment

Fast

Incorporation

Strategic

Location

Skilled

Workforce

Strong Intellectual

Property Protection

Low Corporate

Tax Rates

By following these steps, you can successfully incorporate a company in Singapore from India and leverage the numerous benefits offered by the Jozef for your business growth. If you need assistance or further guidance, consider engaging the services of a professional corporate service provider with expertise in Singapore company incorporation. Good luck with your venture!

“Jozef has done an excellent job of recognising and responding to our critical financial reporting needs. We were also impressed by their global-centric expertise in streamlining complex regulatory issues for us from diverse markets.”

“Thanks to Jozef, we enjoyed a fuss-free financial reporting process. We appreciate the team’s commitment to maintaining compliance, accuracy, and efficiency for our financial reporting needs.”

“Jozef has done an excellent job of recognising and responding to our critical financial reporting needs. We were also impressed by their global-centric expertise in streamlining complex regulatory issues for us from diverse markets.”

“Thanks to Jozef, we enjoyed a fuss-free financial reporting process. We appreciate the team’s commitment to maintaining compliance, accuracy, and efficiency for our financial reporting needs.”

“Jozef has done an excellent job of recognising and responding to our critical financial reporting needs. We were also impressed by their global-centric expertise in streamlining complex regulatory issues for us from diverse markets.”

“Thanks to Jozef, we enjoyed a fuss-free financial reporting process. We appreciate the team’s commitment to maintaining compliance, accuracy, and efficiency for our financial reporting needs.”

Start your Business in Singapore with Limitless Opportunities